In the current environment, bad news supports the S&P 500 but presses down the US dollar. Investors expect the Fed to slow down its monetary tightening, supporting the EURUSD bulls. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Raise the rates! Raise the rates even if the economy suffers and could slide into a recession. If high inflation becomes permanent, the economy will suffer even more. The Bank for International Settlements calls for the Fed, the ECB, and other central banks to raise interest rates. The Fed already hikes the rates aggressively and spares no effort to curb inflation. If other central banks follow this path, the US dollar will be pressed down.

The BIS warned that the global economy could face the same inflationary spiral as in the 1970s unless the regulators act decisively. Although many world’s leading central banks have started monetary tightening, the process should speed up. The real rates are still negative, and the nominal rates should be further raised.

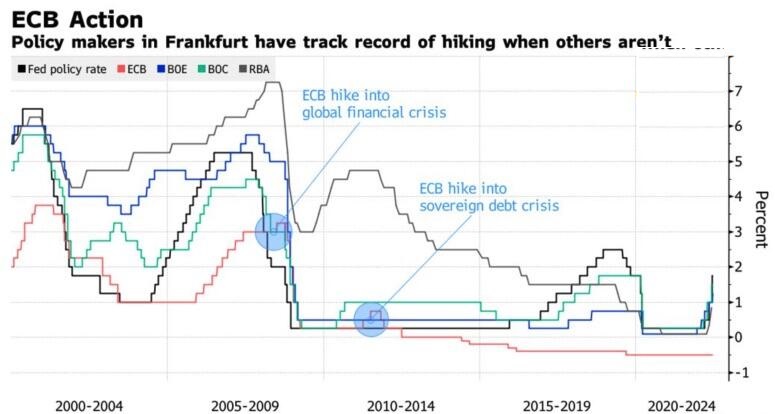

Dynamics of central banks’ interest rates

Investors are interested in another spiral. The Fed vows to act decisively – US dollar rises – economic data worsen – investors expect a pause in monetary tightening – the US dollar weakens. And this repeats over and over again this year. The US dollar rally is still stronger than any corrections down. Things might change.

At the end of June, bad news supports the S&P 500 and presses down the greenback. The University of Michigan’s consumer sentiment index has been down to the lowest on record, and the inflation expectations have been revised to 3.1% from 3.3%. The CME derivatives expect the federal funds rate at 3.31% by the end of 2022, down from the 3.51% expected earlier. The derivatives market has fully priced in the 75-basis-point increase in borrowing costs in June but doesn’t raise its 50-basis-point forecast in September. If the economic activity falls, then the rise in consumer prices may also slow down.

Another good news for the US dollar bears is a fall in commodity prices, including oil. This must slow down the US inflation in Autumn. At the same time, companies’ costs will decrease and the supply of goods and services will increase. Investors understand that the Fed has two ways. In a better case, the PCE growth will slow down amid increased supply. In a worse one, the Fed will have to act more aggressively.

Another bullish factor for the EURUSD is the hope for a soft landing. Not every S&P 500 bear market has been followed by a recession. If this happened, the fall lasted an average of 23.8 months; if not, it was 7.6 months.

Weekly EURUSD trading plan

Therefore, there are some drivers for the EURUSD correction up. Will the euro be strong enough? If the price breaks out 1.0585, it will continue rising to 1.062, 1.068, and 1.072, where sellers must go ahead.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.