A strong UK labor market and inflation that has accelerated to unprecedented levels since 2011 push the Bank of England to raise the interest rate. How will monetary restriction affect the fate of GBPUSD? Let us discuss the market outlook and make up a trading plan.

Weekly pound fundamental forecast

In Forex, traders always act at their own risk, and must understand that in case of incorrect interpretation of the information received, they will lose money. The head of the Bank of England, Andrew Bailey, did not make excuses because he misled the financial markets about the need to curb the raging inflation. The traders are to blame for believing in the BoE head’s assumptions. The interest rate remained unchanged at 0.1%, but they lost money. It’s only the beginning!

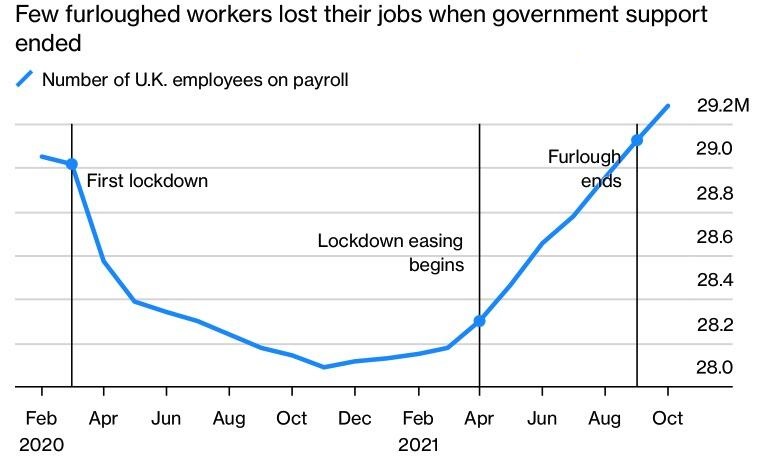

Ahead of the BoE meeting in November, it was not clear how the labor market was doing. There was no data on October inflation either. The Bank of England had to act blindly, and unsurprisingly, and it is not surprising that it refrained from changing monetary policy. At the beginning of the second half of November, it became clear that it was necessary to raise the interest rate. The number of paid employees in the UK in September-October rose by 160 thousand to 29.3 million, and the number of vacancies rose to a record level. It seems that the end of the government’s job support program in early autumn did not negatively affect the labor market, which removes the obstacle to the start of monetary restriction.

While the UK employment rates have started to improve, the inflation situation looks dangerous. In October, consumer prices accelerated to 4.2% YoY, the highest level since 2011. The cost of about 30% of goods and services included in the basket increased by 5% or more. This indicates widespread price pressure and is pushing the Bank of England to raise the interest rate. Derivatives markets consider the issue of its growth by 15 bps in December to 0.25% resolved. The situation was the same before the November MPC meeting, but now the central bank has much more information than it did then.

If the BoE starts monetary restriction, it will overtake the Fed and the ECB and become the first major central bank to do so. Yes, Norway and New Zealand regulators have already started tightening monetary policy, but the Bank of England has an entirely different status.

The problem is that raising the interest rate will create a headwind for the economy, which is struggling to recover and is still about 2% less than before the pandemic. The situation is exacerbated by London’s intention to use Article 16 of the Brexit protocol. Prime Minister Boris Johnson argues that it is legal to suspend part of the deal, and Brexit Minister David Frost wonders if sanctions from Brussels could follow in response. If the EU starts a trade war, the UK will respond immediately.

Weekly GBPUSD trading plan

In my opinion, the increase in the interest rate in the UK will be extremely slow, and the problems of its economy and the Brexit issue will not allow the GBPUSD bulls to break the downtrend. The short-term correction of the pair may continue. However, traders can use rebounds from the resistances at 1.36 and 1.365 to enter sales.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.