Christine Lagarde hinted at the possibility of raising interest rates in 2022. Thus, the divergence between the Fed’s and the ECB’s monetary policies is narrowing, and the EURUSD bulls should go ahead. Let us discuss the Forex outlook and make up a trading plan.

Fundamental euro forecast for six months

The Forex trends could reverse because of an abrupt change in the central banks’ views. The best EURUSD rise since March 2020 is natural. Christine Lagarde abandoned the policy of patience and did not rule out the possibility of raising rates in 2022. It reminds me of the events last June when Jerome Powell did something similar. Since then, the main currency pair has managed to sink to January lows by more than 8%. In February, it’s time for the euro. The king is dead. Long live the king!

There are not only associations with the change in the Fed’s tone in June 2021. In 2017, in Sintra, Portugal, Mario Draghi, the ECB president at that time, hinted at tightening monetary policy, which became one of the three key drivers of the EURUSD rally by 14% at the end of the year. The other two are considered to be the victory of Emmanuel Macron in the presidential elections in France and the first outperforming growth of the European economy over the US one in the last few years. Macron has yet to prove its worth in 2022, but the euro-area GDP may well outperform the US economy, which is deprived of the large-scale fiscal stimulus. Why shouldn’t the euro repeat the success of 5 years ago?

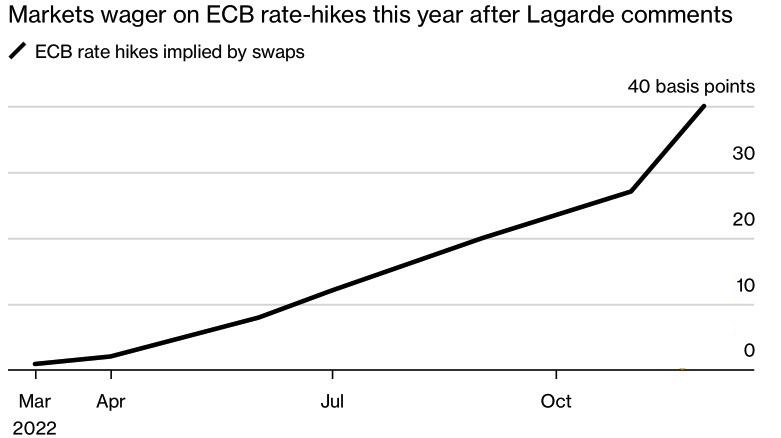

By abandoning the old mantra that rates will not rise in 2022, Christine Lagarde has shown that the ECB is ready to make changes in monetary policy. As a result, the derivatives market raised its deposit rate growth forecast for the current year from 25basis points to 40basis points, 10-year Italian bond yield jumped at the fastest pace since December 2020, and the German bond yield reached its highest level since March 2019. The euro risk reversals turned positive for the first time in a long time, that is, the demand for call options has exceeded the interest in put options.

Christine Lagarde noted that the situation has really changed, inflation will remain at a high level longer than expected, and the prices could continue growing. Lagarde tried to discourage the EURUSD bulls by claiming that demand in the euro area has returned to pre-pandemic levels, and in the US it has grown by 30%. However, it only supported the euro rally. A mentioning of a massive fiscal stimulus in the US that has overheated the economy would have been appropriate last year. This year, no new aid packages are expected, which means that the euro-area GDP could be growing faster than the US.

The EURUSD bears were not encouraged by the drop in the US stock indexes. The stock market is pressed down by technology companies, whose share in Europe is significantly lower than in the USA. It means the money will flow from the USA to the euro area.

EURUSD trading plan for six months

In late January, I warned that the EURUSD downtrend could reverse if the bulls consolidated the price above the supports at 1.115 and 1.11. Another sign of the trend turning up was suggested the price rise above the critical level of 1.132. I recommend buying the euro versus the US dollar with a targe tat 1.18.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.