The rally of US stock indexes is almost the only factor that can save EURUSD. However, it has dragged on too long and is preventing the Fed from doing its job. What consequences can this cause? Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast for a week

If the Fed is hawkish today, tomorrow it can become dovish. This has happened many times before, so a cut in the federal funds rate in 2023 is possible. The stock indexes believe that the Fed is bluffing, claiming that the monetary restriction will continue, and after reaching the peak, borrowing costs will stay at the top for a very long time. These factors, as well as the growth of corporate profits, which exceeded Wall Street experts in three out of four cases, and the stability of the US economy, allowed the S&P 500 to rise by 17% from the levels of the June bottom. The US stock market rally is almost the only factor that keeps EURUSD from falling below parity.

How long will the rally last? Morgan Stanley expects a 9% drop by the end of 2022. Experts from Bank of America believe that the stock index will fall by 16%. On the contrary, one of JP Morgan’s major bulls warns that it makes no sense to expect another S&P 500 drop to level 3500. The Fed risks disrupting the markets by being too hawkish ahead of the US midterm elections.

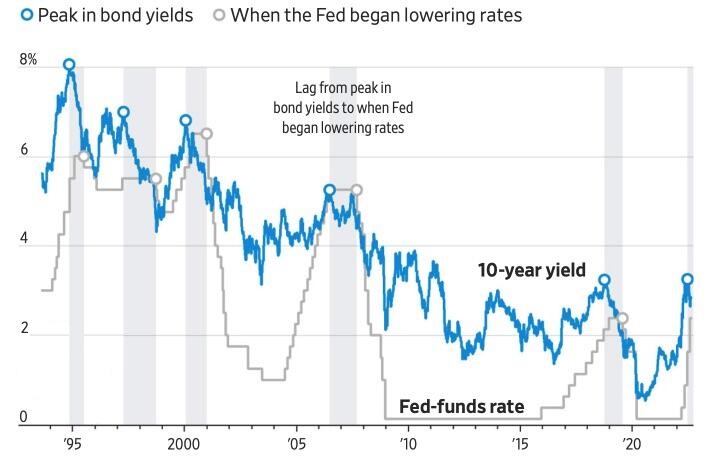

Investors continue to believe in the so-called Fed put, according to which the central bank helps falling markets. This was the case in 2019, when, after a series of increases in the federal fund rate in 2015-2018, the US regulator lowered it. In 2020, the Fed supported stock indices with massive monetary stimulus. The decline in Treasury yields suggests that history will repeat itself. Previously, debt rates declined before the federal funds rate went down.

However, in recent times, inflation has not been as high as it is now, and the markets have not created problems for the Fed by weakening financial conditions. Therefore, the direction of the federal funds rate has been determined. However, how fast will it rise? St. Louis Fed President James Bullard doesn’t understand why it is necessary to postpone the increase in borrowing costs to 2023. Macro statistics are good, and inflation is high. Therefore, it is necessary to set the rate level which restrains economic growth as soon as possible. This includes a rate hike by 75 basis points in September.

On the contrary, the head of the Kansas City Fed, Esther George, notes that monetary policy is influenced by a time lag and calls for caution. She recalled that the Fed is simultaneously winding down the balance sheet, contributing to the economy’s slowdown. CME derivatives indicate a 60% chance that the rate will rise by 50 basis points at the next FOMC meeting.

EURUSD trading plan for a week

Jerome Powell has the opportunity to stop the rally of US stock indexes. Expectations of his hawkish speech at Jackson Hole on August 26 could cause a drop in the stock market, worsening global risk appetite, and a further EURUSD decline below parity. The first shorts’ target at 1.01 has already yielded profits. The next ones are in line, including 0.97. I recommend entering sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.