Back in April, the greenback’s prospects were uncertain. However, if the US economy is still strong, and the Eurozone and China are losing ground, isn’t it time to sell EURUSD? Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

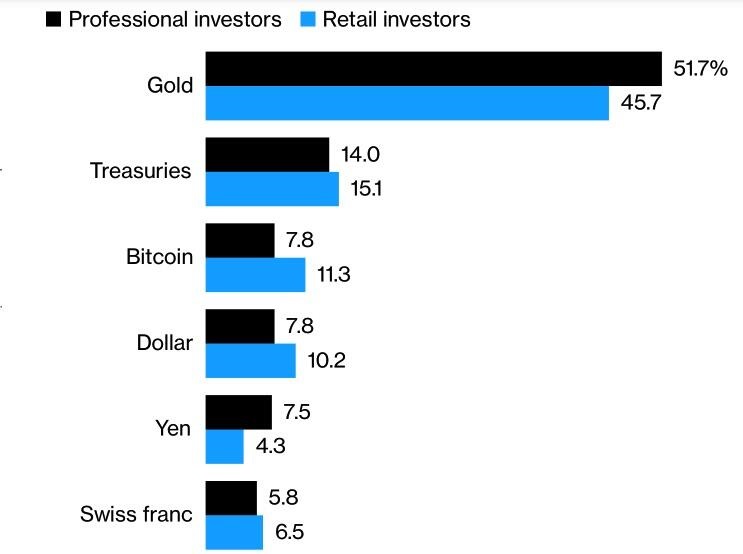

When the risks of a US recession recede, Fed officials doubt whether it is worth pausing or continuing to raise rates, and the default is about to begin, finding something better than the US dollar is difficult. According to a survey of 637 professional investors by MLIV Pulse, a greenback is the best option for investing money in Forex if the US cannot pay its obligations. The USD is only outperformed by gold, bitcoin, and treasuries. 60% of respondents believe that the risks are higher than in 2011. At the same time, the majority hopes that the actual probability of a default is low.

Interest in the greenback is growing as the possibility of a US recession declines. Two out of three asset managers surveyed by Bank of America are counting on the US economy’s soft landing. The survey was conducted among 251 respondents who manage $666 billion. Presidents of the Atlanta Fed Rafael Bostic and the Chicago Fed Ostan Goolsby also say the recession will be avoided. Bostic is confident that inflation will return to the target without a significant deterioration in the labor market and opposes market bets for a 2024 dovish reversal.

Retail sales data further delayed the start of the US recession. After a decline in February-March, the figure rose by 0.4% MoM and 1.6% YoY, beating Bloomberg forecasts. While consumers are cautious, they are still strong, which is good news for the economy and the US dollar. Disappointing data on Chinese industrial production, retail sales, and investment undermine the euro’s position. Hopes for a rapid recovery of the Chinese economy after the pandemic are not justified, which indicates that the EURUSD is overbought.

Previously, the greenback fell when the recession approached the US, the eurozone avoided recession, and China could become the leader of global economic growth. In May, it became clear that not everything is as bad in the US as expected, and the European-Asian alliance is overestimated. As a result, speculators began to exit euro long trades, which provoked a correction.

The resilient economy, persistently high inflation, and inflation expectations soaring to the highest level since 2011 make Fed officials doubt that the federal funds rate peak has been reached. Cleveland Fed President Loretta Mester does not believe that the borrowing cost is already at a level where the chances of its decline and growth are the same. The derivatives market increased the probability of its increase in June to 22%.

Weekly EURUSD trading plan

EURUSD correction will continue. The macroeconomic background strengthens the US dollar, and hedge funds understand this. A breakout of support at 1.0855 serves as a reason to add up to short trades. Focus on level 1.076 as an initial target.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.