The US economy acceleration changes the EURUSD situation. If there is no recession, what is the point of the euro purchases? USD regains its former strength, but for how long? The higher the rates, the greater the chances that a recession will start, though a bit later. Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

For a long time, economists have been arguing about how the US economy will end up — falling into a recession or with a soft landing when the GDP growth slows significantly without a recession. Strong jobs report added a third “no landing” option. According to Goldman Sachs, the probability of a US recession within 12 months has decreased from 35% to 25%. Instead of declining, the economy, on the contrary, begins to rise. This means that the EURUSD bears are regaining their former strength.

Alas, the “no landing” scenario is a temporary phenomenon. The Fed will be forced to raise the federal funds rate higher and keep it at its peak for longer than markets suggest. They have already begun to adjust their expectations. CME derivatives give a 90% chance that the borrowing cost will rise above 5% compared to 45% before the release of US employment data for January. The chances that rates will remain at their peak until the end of the year have increased from 3% to 45%.

Is the resumption of bear trends for US Treasuries and EURUSD unexpected? An increase in annual inflation expectations from 2.4% to 3.9% contributes to the sale of treasuries and the growth of their profitability. When the indicator remains at the bottom, the Fed may not pay attention to weakening financial conditions. However, when it starts to rise, the central bank has to punish the markets.

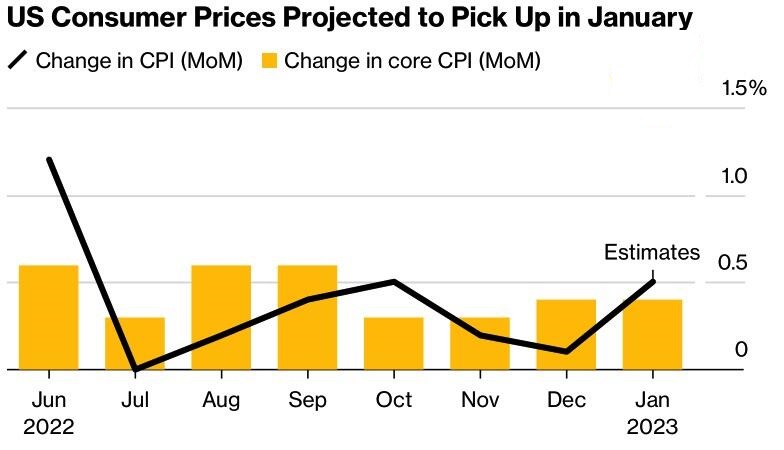

US inflation data for January may intensify the collapse of stock indices and Treasury yields, which will strengthen the USD. Do not delude yourself about the slowdown in consumer prices from 6.5% to 6.2% and the basic indicator from 5.7% to 5.5% YoY. Monthly indicators are more important.

The acceleration of CPI to 0.5% and core inflation to 0.4% MoM will once again prove that the Fed’s job is far from done. Markets will believe in additional federal funds rate hikes and abandon the idea of a dovish reversal, which will return the US dollar to its former glory.

Annual figures are unreliable due to the high base effect. Inflation accelerated significantly in 2022, and prices need to rise quickly to surpass last year’s figures. Most likely, CPI will drop below 6%. If monthly forecasts are confirmed, this may become the basis for exiting EURUSD short trades and push the euro higher.

Weekly EURUSD trading plan

Inflation acceleration monthly contributes to the EURUSD decline. Those who entered short trades at 1.0705 can hold them until the important release. The idea of EURUSD consolidation in the range of 1.06-1.085 is still relevant. However, no one knows how events will develop further.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.