The Fed is facing a conflict of interest. On the one hand, it must fight inflation. On the other hand, ensure financial stability. Bank failures create difficulties for the US regulator, which forces the futures market to return to the idea of a dovish reversal. Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly US dollar fundamental forecast

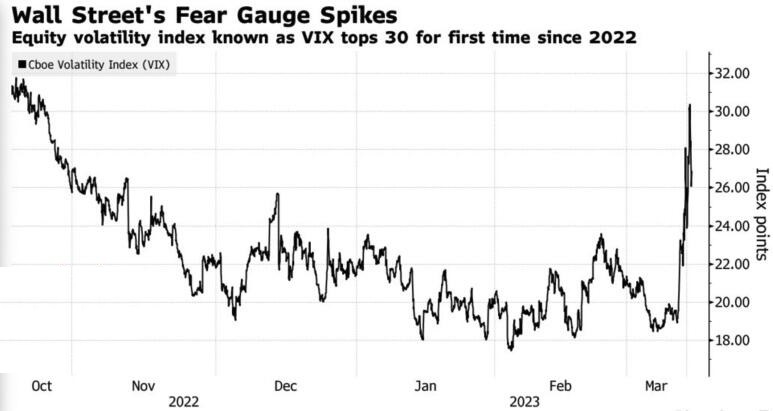

When there is panic in the markets, Joe Biden’s statement that Americans can be confident in the safety of the banking system only irritates the public. The Fed, the Treasury and the Federal Deposit Insurance Corporation have taken unprecedented measures to rescue depositors who were 90% to 95% uninsured by bankrupt banks. However, it is the scale of the measures that makes investors even more afraid. The VIX volatility index soared to its highest level since October, and EURUSD returned above 1.07 again.

How can SVB and Signature Bank, with a market value of $209 billion and $110 billion, respectively, deprive the economy of ten trillion dollars? However, investors very quickly linked the bankruptcy to the Fed’s monetary tightening. There is a saying in the market that when the Fed raises rates, something breaks. It is not known whether the measures taken by the regulators will be able to save the banking system and restore confidence in the stock market.

In fact, the Fed is faced with a conflict of interest. Its mandate mentions both fighting inflation and ensuring financial stability. Prices are still high, but the monetary restriction cycle needs to be put on hold to calm everyone down. Unsurprisingly, under these conditions, derivatives with a 66% probability predict a 25 bps increase in the federal funds rate at the March FOMC meeting, while the chances that it remains the same are twice lower (34%).

DoubleLine Capital claims that +25 bps in March will be the last in the cycle. Goldman Sachs believes that there will be no rate hike at the next FOMC meeting, while Nomura predicts a reduction. Although a couple of days ago, the markets were confident in the indicator’s growth by 50 bps! How can the USD not fall under such conditions?

The decline is facilitated by the collapse of treasuries’ yield on two-year securities (the worst since 1987) that are sensitive to the Fed’s monetary policy.

Due to bankruptcies, investors forgot about the most important inflation data. Bloomberg experts predict a slowdown in consumer prices from 6.4% to 6% and the core indicator from 5.6% to 5.5% YoY. However, monthly data will be much more important. Can the data release stop EURUSD bulls? Quite possibly, but a potential surprise from the ECB is much more significant.

Weekly EURUSD trading plan

French Finance Minister Bruno Le Maire argues that the situation with US banks is unique and does not threaten Europe due to the lack of close ties with the technology sector. However, the derivatives market lowered the expected deposit rate ceiling from 4% to 3.2%. At the next meeting, the Governing Council may refuse to raise the rate ceiling by 50 bps, which will hit the euro. The inability of EURUSD to consolidate at 1.0705 could be a reason for entering short-term sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.