Be careful when selling EURUSD at current levels. It’s also dangerous to buy new S&P 500 highs. Many positive factors have already been priced in the USD. Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

Morgan Stanley experts believe the US stock market is in a death zone with the risk premium on buying securities at its lowest level since 2007, while new highs will bring the bulls a lot of trouble. Strong US macro statistics lead to a fall in stock indices and EURUSD due to fears that the future recession will be much deeper than the one that should have already begun.

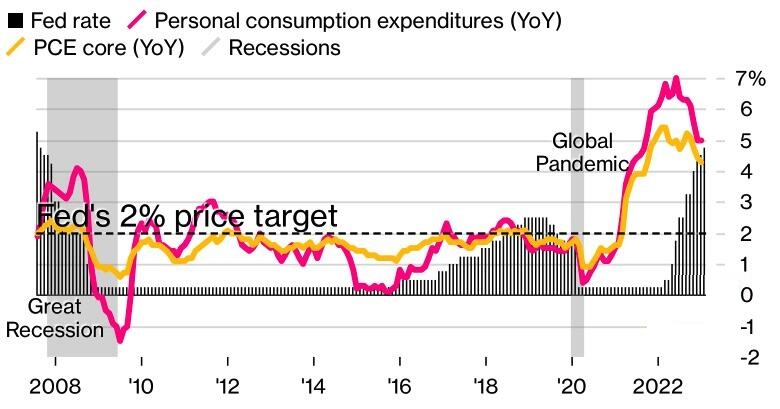

As history shows, the S&P 500 only bottomed after the Fed raised the federal funds rate to the ceiling. Then the recession began, contributing to the stock index’s decline. In the current environment, this means that a recession is either about to start. Otherwise, the economy will accelerate, the Fed will tighten monetary policy even more, and the GDP contraction will be much deeper than investors expect. Purchasing stocks and getting rid of the US dollar now is like believing in a fairy tale.

Be careful when selling EURUSD at current levels. It’s also dangerous to buy new S&P 500 highs. Many positive factors have already been priced in the USD. Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

Morgan Stanley experts believe the US stock market is in a death zone with the risk premium on buying securities at its lowest level since 2007, while new highs will bring the bulls a lot of trouble. Strong US macro statistics lead to a fall in stock indices and EURUSD due to fears that the future recession will be much deeper than the one that should have already begun.

As history shows, the S&P 500 only bottomed after the Fed raised the federal funds rate to the ceiling. Then the recession began, contributing to the stock index’s decline. In the current environment, this means that a recession is either about to start. Otherwise, the economy will accelerate, the Fed will tighten monetary policy even more, and the GDP contraction will be much deeper than investors expect. Purchasing stocks and getting rid of the US dollar now is like believing in a fairy tale.

Weekly EURUSD trading plan

The release of the minutes of the last FOMC meeting will allow EURUSD to update the February low. However, there is a good chance that the bulls will start strengthening in the zone of 1.056 – 1.058. When the price rebounds from it, switch to long trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.