The market understands that the Fed’s policy is data-driven but does not want to get rid of the idea of a dovish reversal in 2023 despite strong US employment data. Who is wrong? Investors or the central bank? Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly US dollar fundamental forecast

Possibly, in the long run, the markets reflect reality. However, now they resemble a polling station, where each investor has their own views on what will happen next. The most common opinion in Forex is that no matter how strong the US economy is, the Fed will have to cut rates. Their high values, a long stay without drastic changes, and the risks of default due to the debt ceiling and the banking crisis will, in any case, provoke a recession. That’s why EURUSD grew in response to strong US employment data.

A rise in employment of 253 thousand, a fall in unemployment to 3.4% (the lowest level since 1969), and an increase in average wages to 4.4% in April should have forced the euro to step back. Especially since Jerome Powell argued that an increase in average wages of about 3% is required for inflation to return to the 2% target. The job market is too hot, and rumors of an economic crash are exaggerated to commit a dovish reversal in 2023.

Employment growth has exceeded Bloomberg’s forecasts for the 13th month in a row. Since the beginning of 2022, the US has added 6 million jobs compared to the expected 4.2 million. If a recession is coming, then someone forgot to tell the US economy about it.

Not surprisingly, EURUSD‘s first reaction to US employment data was to fall to the previously announced level of 1.097. However, then the pair rebounded from it and rose. At first glance, the main reason for strong fluctuations was the downward revision of employment figures for February-March, but the reason is different.

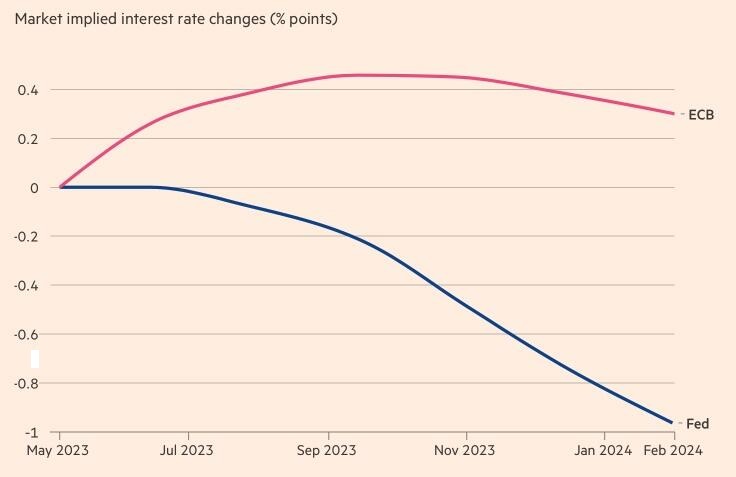

As markets wait for a recession, they perceive any non-increase in borrowing costs as a form of tightening, eventually leading to a recession. In addition, the divergence in monetary policy may yet begin. According to Union Investment, the ECB/Fed monetary policy divergence is completely new. Previously, it was thought that it was pointless to predict the ECB’s actions since it would still stop at -200 bps from the federal funds rate. However, now the European Central Bank is ready to act on its own.

Derivatives insist on Fed’s dovish reversal and count on one or two ECB monetary restrictions acts. At the same time, investors use any chance to buy EURUSD.

Weekly EURUSD trading plan

The market is wrong and is beginning to understand it. It reduced the chances of the Fed’s monetary tightening in July from 50% to 38% and from 90% to 75% in September. There is a 9% chance of a rate hike in June. If the US April inflation is stable, the Fed will postpone the dovish reversal to a later period. This creates prerequisites for EURUSD sales from the convergence zones of 1.104-1.1055 and 1.1125-1.114.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.