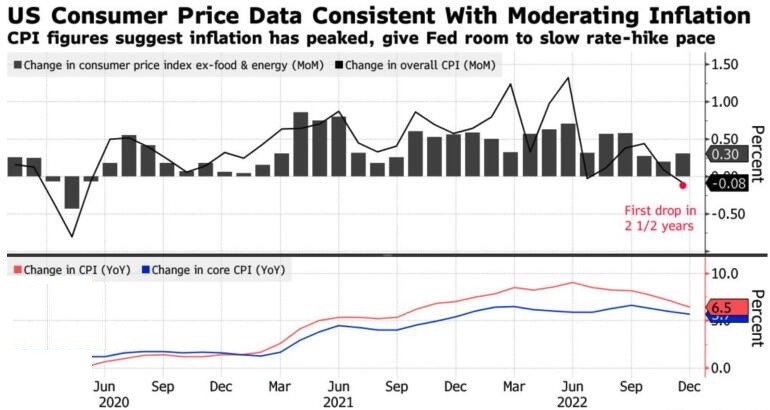

Earlier, the Fed raised the rate several times by 75 bps and then slowed down to +50 bps. Now the US regulator is ready to go to the standard +25 bps. How does this circumstance, along with the change in macro statistics, affect EURUSD? Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

Macro factors, which in 2022 contributed to the USD growth to 20-year highs, are now acting in the opposite direction. Global growth is accelerating, and macroeconomic and inflationary uncertainties are easing. In addition, the Fed, which has decided to slow down the monetary restriction rate, finds it difficult to resist its main competitors. One of them is the Bank of Japan intervening in foreign exchange and loosening control over the yield curve; the other one, the ECB, is acting hawkish. Not surprisingly, EURUSD remains stable even as the S&P 500 falls.

The bad news for US stocks is finally turning really bad. The stock market is scared by the delayed effect of the Fed’s monetary restriction. In 2022, the central bank raised rates by 425 bps, and now investors anticipate how this will affect the US economy. FOMC officials are aggravating the situation. Lael Brainard noted that businesses and households have yet to experience the effects of last year’s borrowing costs increase. Her colleague John Williams stressed that shifting gears of monetary policy tightening is already producing the desired results. By the end of the year, he expects inflation to slow to 3%, unemployment to rise to 4.5%, and GDP to expand by 1%.

Fed Vice Chairman said that US inflation remains at elevated levels despite the slowdown. Therefore, monetary policy should be sufficiently restrictive for some time to ensure that PCE returns to the 2% target. New York Fed president believes that the Fed still has a lot of work to do.

Reuters experts predict that the Fed will raise the federal funds rate by 25 bps in February and March, after which it will pause. The borrowings’ cost will rise to 5%, which is in line with the expectations of the derivatives market and FOMC forecasts. 60% of respondents believe that rates will remain at their peak until the end of 2024. At the same time, 34 out of 89 economists noted that in 2023 the cost of borrowing is likely to be reduced. 16 experts named the inflation slowdown as the main reason for the dovish reversal.

Morgan Stanley’s bullish forecast about EURUSD’s rise to 1.15 is based on changes in the global macroeconomic environment and a slowdown of the Fed’s monetary tightening. On the contrary, JP Morgan believes that the federal funds rate will have to be raised to 6%, which will strengthen the USD. Time will tell who was right. Meanwhile, the ECB is beginning to actively intervene in the fate of the main currency pair.

Weekly EURUSD trading plan

Christine Lagarde and Bank of the Netherlands President Klaas Knot said that a 50 bps increase in the deposit rate in February would not be the last such move. As a result, EURUSD managed to resist the pressure of the S&P 500 decline and is ready to continue the rally towards 1.095. I recommend entering purchases.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.