Why is the dollar rising? Is it because of the safe-haven asset status ahead of a potential US default? However, the market’s faith in the agreement between Democrats and Republicans pushed the EURUSD even lower. Why? Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

The biggest mistake traders make is believing in dogmas. Gold is a hedging instrument to manage price risks. But why did it fall in 2022 when US inflation hit a 40-year high? Isn’t it paradoxical that the XAU rise to record highs against the backdrop of a slowdown in US CPI and PCE? The same goes for the dollar. It is supposedly strengthening as a safe-haven asset due to approaching default. How to deal with EURUSD’s rapid collapse after default risks dropped sharply?

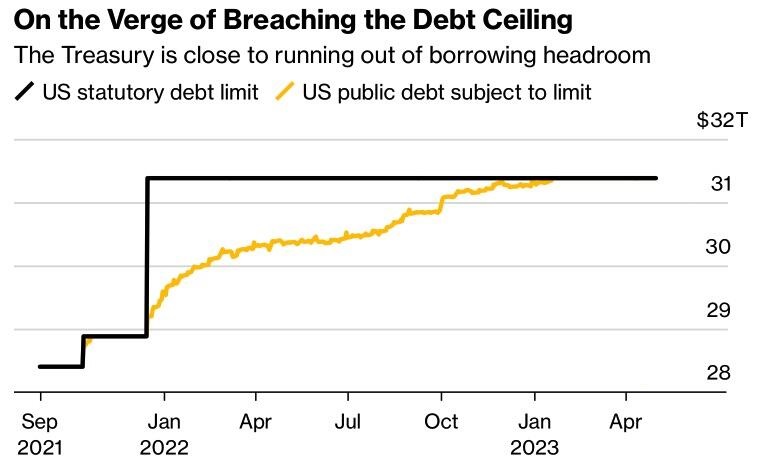

Joe Biden’s confidence in reaching an agreement with the Republicans, as well as the statement by Speaker of the House of Representatives Kevin McCarthy that a vote on the national debt ceiling will take place as early as next week, allowed the markets to heave a sigh of relief. There is growing confidence that a crisis in the economy and financial markets will be avoided. This means Fed officials may continue to raise rates.

Both the threat of default and the banking crisis prevent the Fed from fighting inflation. After 2011, the US central bank developed a system of responses to a potential US failure to repay obligations. They included both the purchase of treasuries (the QE) and the permission for collateral for loans issued by the Fed to commercial banks. Jerome Powell called these options disgusting as they risked violating the Fed’s principle of non-interference in fiscal policy.

Thus, the unresolved issue with the debt ceiling serves as a basis for the Fed to loosen monetary policy. This is a negative for the US dollar, which is why it is growing against the backdrop of a decrease in the degree of danger.

History shows that the greenback’s status as a safe haven has nothing to do with its current strengthening. In 2011, when everyone expected a potential default, the problem was solved a few hours after the deadline due to turmoil in the financial markets. However, EURUSD has been relatively quiet compared to other assets.

The main driver of USD strengthening is the increase in the possibility (from zero to 33%) of raising the federal funds rate to 5.5% in June, as well as a decrease in the chances of a dovish reversal. FOMC officials Lorie Logan and James Bullard are ready to vote for monetary restriction at the next Fed meeting. Their colleague Rafael Bostic does not exclude the growth of borrowing costs in July after a pause in June.

Weekly EURUSD trading plan

How low can EURUSD fall? In previous articles, I assumed that after the price reaches the short target at 1.076, the pair will stabilize, referring to the market’s abandonment of the idea of a dovish reversal in September. However, its chances in November and December are still high. If they start to fall, the euro could collapse to $1.066 and $1.06. Thus stick to short trades entered in 1.1040-1.1055.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.