Even if investors are right that inflation in the US has begun declining, the market overreacted a bit. This is a position we must rethink. Let’s discuss the topic and make up a trading plan for EURUSD.

Weekly US dollar fundamental forecast

This time investors are right about slowing inflation. However, it is always dangerous to go against the Fed. This creates a threat of a counter-reaction from the central bank, dissatisfied with the weakening of financial conditions. The last thing the Fed wants is for markets to reinflate the economy again. The US regulator is starting to fight them, which increases the risks of the EURUSD decline.

November events are reminiscent of summer but on a larger scale. Yields on 2-year Treasuries have grown at the fastest pace since the Lehman Brothers’ bankruptcy in 2008 and September 11 attacks. Its dynamics were equal to a decrease in the federal funds rate by 25 bps. Like in November, it rose not to 4%, but to 3.75%.

The S&P 500‘s 5.5% rally and the US dollar’s decline, slightly slower than during the 1985 Plaza Accord intervention, returned financial conditions to the levels that occurred before the Fed’s 75 bps monetary tightening in September. It should be noted that after it, the rate was raised by another 75 bps. Financial conditions collapsed as during the March 2020 pandemic and the Fed’s emergency response to the 2008-2009 global economic crisis.

The Fed doesn’t like it. So, FOMC officials begin to act aggressively hawkish. According to New York Fed President John Williams, the central bank should not be led by the markets. Christopher Waller says a single report will not mislead him and it is too early to say that inflation has peaked. Kansas City Fed President Esther George notes that there may be a chance to avoid a recession, but in 40 years of her work, she has not seen anything like this. But the expectations of avoiding a recession have become one of the drivers of EURUSD growth.

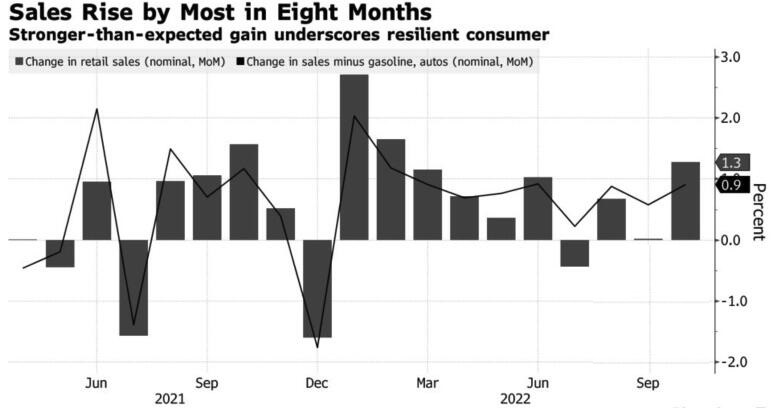

Meanwhile, the strongest retail sales growth in 8 months reinforced the decline of the S&P 500 and the euro. A strong economy allows the Fed to raise rates freely.

Retail sales rose 8.3% YoY and consumer prices 7.7% YoY. The expansion of the base indicator by 0.7% MoM gave reason to the leading indicator from the Atlanta Fed to raise its estimate of US GDP growth in the fourth quarter from 4% to 4.4%.

Once again, bad news for the economy is perceived as good news for the S&P 500 and vice versa. The Fed’s intention to take revenge and the strong economy gives Goldman Sachs reason to raise the expected peak of the federal funds rate from 4.75-5% to 5-5.25%.

Weekly EURUSD trading plan

Thus, investors are right about slowing inflation, but the Fed is still running the show. Fed officials’ anger allows traders to continue EURUSD short-term sales following a breakout of support at 1.033. Enter long trades when the price rebounds from the levels 1.022, 1.015 and 1.01.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.