The market predicts a recession four times out of nine. Now, betting on a soon end of the conflict in Ukraine could also be wrong. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

The price includes everything. This is the idea all fans of technical analysis believe in. They claim all events of an economic, political, or other nature are already are priced in the quotes of financial assets. Looking at what has recently happened in the financial markets, one could assume the conflict in Ukraine has been over. The S&P 500 was 5% up over three days, oil and gold opened the week with a crash, the US dollar was weakening against a basket of major currencies, and the EURUSD broke above 1.11, heading towards 1.13 where the price had been trading before the conflict in Eastern Europe.

Experienced investors know that market predicts a recession four times out of nine. Differently put, it is quite often wrong. I don’t believe that Moscow will withdraw troops from Ukraine just because Kyiv will enshrine the neutral status of its country in the Constitution. But what about the Crimea? Donbas? Ukraine’s intention to maintain territorial integrity? These issues can take months, if not years, to resolve. Of course, I can be wrong, as I did with regard to the invasion, but still, there is a chance I am right.

I suppose fear leaves the market and there comes greed. Investors remember how fast the US stock indexes recovered after the recession. So, they do not want to miss out on the S&P 500 rally now. Furthermore, JP Morgan claims that the correction of tech, biotech, and emerging markets stocks, the so-called bubbles, is coming to an end. Geopolitical risk will begin to ease over the coming weeks, although a comprehensive solution will take several months.

The market is full of optimists who believe that China will soon lift the lockdown and provide huge stimulus. They are satisfied with Vice Premier Liu He’s vague statements about Beijing’s upcoming market-friendly policies and easing restrictions in Shenzhen’s five districts. Kyiv’s statements that Moscow’s position is becoming more adequate also encourage bulls. For them, it is enough to see in Jerome Powell’s comments signs that the Fed, despite the hawkish speeches, won’t be too aggressive to trigger a recession.

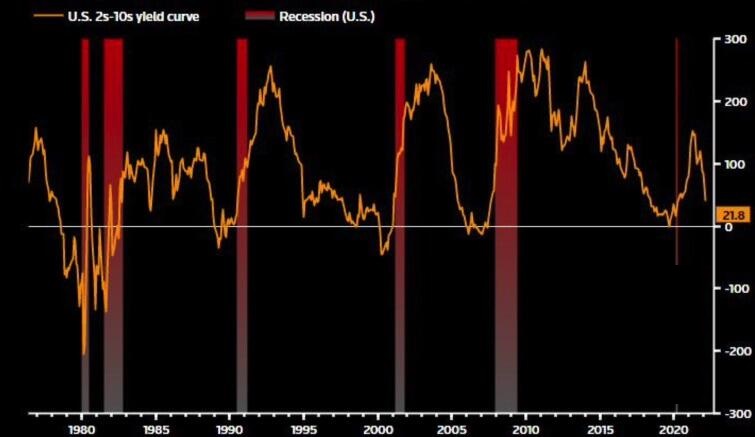

Yes, the Fed intends to raise the rates at every meeting in 2022 and bring it above neutral levels, but the policymakers believe that monetary tightening won’t lead to the deterioration of the labour market and a recession. The central bank forecasts that unemployment will remain below 4% until 2024 despite aggressive monetary restrictions and unwinding the balance sheet. The bond market doesn’t seem to believe, as evidenced by the narrowing spread between the yields on 10-year and 2-year Treasuries towards zero.

Weekly EURUSD trading plan

As I noted, there are a lot of optimists led by greed in the foreign exchange and stock markets. Investors fear of missing out the S&P 500 rally. The matter is whether they are right. I don’t think so. I recommend selling the EURUSD if the price goes down below 1.105.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.