The Fed is doing a great job, using both traditional tools and psychology. However, the stock market puts pressure on the central bank. How will this affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

When the Fed says the US economy is far from recession, it makes Americans think about crisis, reducing the domestic demand and pressing down inflation. Furthermore, both the yield curve inversion and the contraction of GDP for two quarters in a row clearly hint at a recession in the economy. A drop in the employment rate will fuel up the worries about an upcoming crisis.

The US labour market is not overheated, but it is still strong. Reuters experts predict a drop in nonfarm payrolls in July to 250,000, which will be the smallest number in a 19-month period and well below the semi-annual average of 457,000. Estimates ranged from +75,000 to +325,000. The labour market is cooling, but that’s exactly what the Fed needs.

Along with the psychology talks about the recession, one of the main ways that the central bank manages inflation is by reducing employment. The Fed raises rates, funding becomes more expensive, companies have to choose between paying creditors and employees, and creditors win. People have less money, their expenses decrease, and prices stop rising as much as before.

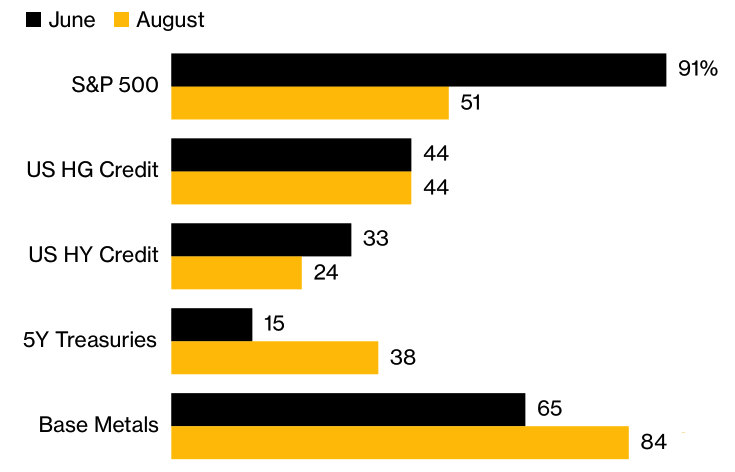

Jerome Powell and his fellow central bankers are doing an excellent job, but they have one problem. It is the financial market that behaves like a naughty child. The S&P 500 is up 13% from its June low. According to the JP Morgan model, its rally signals that the probability of a recession in the US economy over the next 12 months has decreased from 91% to 51%. In general, only commodity markets hint at a serious threat of a downturn.

The stock market ignores the talks about the recession. Investors believe that the Fed will not raise the rates as much as the FOMC forecast suggests and start lowering them in 2023. Growing risk appetite encourages consumers, and inflation will remain high. Financial conditions are loosening, which is the opposite of what the Fed wants.

The S&P 500 ignores the FOMC hawkish speeches and believes in a slower monetary tightening. Will the Fed meet the market expectations?

Weekly EURUSD trading plan

I believe a weak US jobs report will not break the EURUSD downtrend. The price could break out the upper border of the trading range 1.01-1.03 and go up to 1.0355 and 1.0395, where the bears will go ahead. It could be relevant to enter short-term longs, followed by medium-term shorts. If the euro goes below $1.018, it will be relevant to sell.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.